Debit &

ATM Cards

your money when you need it

We’re committed to making your life easier, and our debit card helps with that. The Honor Credit Union MasterCard Debit Card lets you shop your way and use ATMs to access your cash.

Secure Transactions

With EMV Chip Technology

Access Over 30,000+

Surcharge-Free ATMs

Instantly Receive

Alert Notifications

Pay With The

Tap Of Your Phone

Find a Surcharge-Free ATM

If you need cash, you can visit any of our local member centers, or our local community ATM’s (found below). You can also use the various links provided here to find an ATM near you today!

Local ATMs

Battle Creek

- VA Medical Center, 5500 Armstrong Road

Benton Harbor

- Pri-Mart Citgo, I-94 Exit 29 at Pipestone Road

Buchanan

- Country Heritage Credit Union: 16580 Bakertown Road

Stevensville

- Watermark Brewing Company: 5781 St. Joseph Ave

Find An ATM

You have access to local Honor ATMs, and surcharge-free ATMs across the country through the CO-OP Network.

ATM Video Tellers

Our ATM Video Teller machines allow us to provide face-to-face service for our members through the use of video technology. An Honor Team Member will help you conduct any of the financial transactions that you’re used to performing through the drive-thru, right through the machine. An added bonus is these machines function like a regular ATM 24/7!

Find An ATM Video Teller

How Does A Video Teller machine work?

After pulling up to a machine, simply touch the screen to speak directly with one our real Video Tellers. They’ll be happy to assist you with all of your transaction needs. Or, you can choose to use the ATM without assistance to: withdraw cash or make deposits without an envelope.

What Types Of Transactions Can I Do?

You can perform virtually any transaction that you normally would at any other member center’s drive-thru via these machines, which include:

- Make deposits

- Make withdrawals

- Cash checks

- Transfer money

- Make loan or credit card payments

- Receive balance information

As a self-service option, you can also use the Video Teller machine as a traditional ATM, allowing you to perform financial transactions on your own without live assistance.

What Are The Hours Of A Video Teller Machine?

One of the biggest benefits that comes with our new ATMs is the expanded hours! The Live Teller feature is available:

- Monday – Friday: 8:00 AM – 6:00 PM

- Saturday: 9:00 AM – 12:00 PM

Please Note: Outside of the noted hours, you can perform the following transactions:

- Make deposits

- Make withdrawals

- Deposit checks

- Transfer money

- Receive balance information

What Do Video Teller Machines Look Like?

You will notice our Video Teller machines look very similar to traditional ATMs, but the screen will be interactive and you will have a live Honor team member assisting you right on the screen. Some new ATMs will be installed in the side of our member center buildings in the drive-thru.

Card control

This feature on the Honor mobile app lets you manage your debit card from the palm of your hand. You can turn a card off/on, receive card activity notifications or report a card lost or stolen. This feature also gives you quick access to view recent activity on the card to help you detect fraud.

Enabling Card Control

- Download Honor’s Mobile App – First and foremost, you’ll have to download our mobile app on your Apple or Android mobile device.

- Manage My Cards – From the main bottom toolbar, select “More” and “Manage My Cards.”

- Set Your Preferences – Here you will find a list of all your active debit or credit cards and you can set your personal preferences as to what notifications you would like to receive.

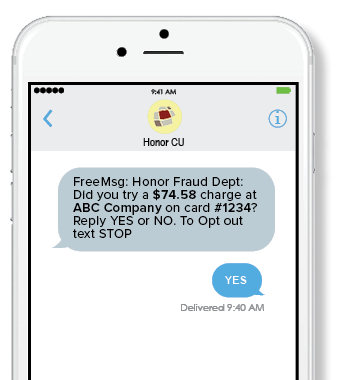

text & Call Alerts

To help protect your money, when fraudulent activity is suspected with a card, no matter if it’s your credit card or debit card, your transaction may be declined (some lower risk transactions might go through).

How We'll Reach Out

- Text Message – You’ll receive free text alerts 24/7 anytime possible fraud is identified. If you recognize the transaction and authorize it reply “YES”, otherwise reply “NO.”*

- Voice Message – When your primary contact number is a landline, you’ll receive voice call alerts between 9 AM and 9 PM in your time zone. You’ll be prompted to answer questions during the call to confirm the transaction or you will be transferred to a representative if the transaction was not recognized.

- Email – If we cannot reach you after several attempts, an email will be sent to the address on file explaining why your card was blocked.

* SMS/Text is free to members with mobile service through Verizon, AT&T, or Sprint. Other usage costs may apply based on your mobile carrier.

* SMS/Text is free to members with mobile service through Verizon, AT&T, or Sprint. Other usage costs may apply based on your mobile carrier.

Card Support

Important Numbers

CU*Talk Voice Banking

Debit & Credit Cards

- Card Activation: 800.992.3808

- Lost or stolen card: 844.773.1021

Travel Information

- If you’re planning an international trip, keep us informed by stopping by a member center or giving our Virtual Member Center a call at 800.442.2800 to let us know to expect transactions from your desired destination.

- Beware of blocked and sanctioned countries. For a current list of these countries check out the Office of Foreign Asset Control (OFAC) of the US Department of Treasury’s list. If the country you are visiting is on this list, ALL card activity will be blocked per the requirement from OFAC. On occasion, Honor Credit Union may block countries in addition to those listed on the OFAC list, but should there be additional countries, they would be listed here.

Fraud Protection

- If you suspect fraud you can turn your card off instantly from within the Honor mobile app.

- Honor debit and credit card holders are automatically enrolled in our free card protection program. Cardholders can sign up for additional free MasterCard fraud services.

- If we suspect fraudulent activity, the transaction will likely be declined and your account will be blocked to prevent further harmful activity. We will attempt to notify you as quickly as 30 seconds after a suspicious transaction takes place.

Debit Card Round up

Our Debit Card Round Up program, formerly known as “It’s Your Change,” allows you to easily save money. Each debit card purchase will automatically round up to the nearest dollar, and the remaining change will be deposited into your savings account. Just like putting your pennies and dimes in a jar, you’ll be surprised at how much you can save without even thinking about it!

How It Works

- Debit Card Round Up is free and available to any member with a checking account and an active debit card.

- With Debit Card Round Up, each debit card transaction is automatically rounded up to the nearest dollar and the change is deposited into an account of your choosing.

- Funds can be deposited into your main savings account, a money market, or create a separate savings account and watch those dimes and nickels add up!

How To Enroll

Members can enroll in online banking or the mobile app 24/7. You can also call us at 800.442.2800 or stop by any member center.

- Log in to online banking

- In the Member Services menu tab select Debit Card Round Up

- Select the eligible checking account you would like to enroll

- Choose the option “I would like to round up purchases on my debit card for this account”

- Select which savings account you would like the amount to be deposited into and click Update

- Log in to the Honor mobile app

- Tap More on the bottom right

- Scroll down and tap Debit Card Round Up

- Select the eligible checking account you would like to enroll

- Choose the option “I would like to round up purchases on my debit card for this account”

- Select which savings account you would like the amount to be deposited into and click Update

digital wallet

Shopping has never been easier with solutions like Apple Pay™, Google Pay™, and Samsung Pay™. There’s no reason to lug around a thick wallet or big purse with credit cards and debit cards. Simplify your life by making your purchases with the touch of your finger by connecting your Honor debit card to your phone today.

Add It To Your Phone

- Apple Pay – Use your eligible iPhone, Apple Watch, or iPad to conveniently make purchases at participating merchants.

- Google Pay – Android users can use their phone to make payments at more than one million stores across the United States.

- Samsung Pay – Members with eligible Samsung phones can make payments to earn reward points redeemable for instant-win opportunities and other deals.

Debit Card FAQs

It really is up to you, because both debit and credit will take the money out of your account right away. But, if you have a Benefits checking account, you will want to swipe your card as credit at least 12 times per month to help meet the requirements to earn your interest!

Yes. Just be aware of the following guidelines:

- Simply give us a heads up before you leave by calling us at 800.442.2800 or stop by a local Honor member center so we know to expect transactions from your destination.

- Beware of blocked and sanctioned countries. Here is a current list of those countries from the Office of Foreign Asset Control (OFAC) of the US Department of Treasury. If the country you are visiting is on this list, ALL card activity will be blocked per the requirement from OFAC. On occasion, Honor Credit Union may block countries in addition to those listed on the OFAC list, but should there be additional countries, they would be listed here.

- While debit and credit cards are accepted in most countries, MasterCard charges foreign currency conversion fees for purchases made with their credit and debit cards, in addition to ATM cash withdrawal fees.

Yes! Most Honor member centers have the ability to instantly print a new or replacement card within minutes.

Yes. In most cases your checking and savings are both connected to your debit card. If you aren’t sure, give us a call or stop by a member center. Just remember, all Honor savings accounts are limited to six free withdrawals per month.