Online

Banking

Access Your Money 24/7

Download the Honor App

Online Banking Features

With free online banking access, you can do a lot of the things you would normally do in a member center, such as transfer money, pay bills, open additional checking and savins accounts, and more. Plus, there are many additional things you can do online. See below for all the details.

What You Can Do

- Review the balance of your checking, savings, money market, certificate of deposit, and loan accounts

- Transfer funds between your accounts, and to other members

- Use Instant Deposit to gain early access to pending ACH transactions, such as your paycheck

- Download account details to Microsoft Money or Intuit Quicken

- Set alerts for when automatic deposits or withdrawals are processed by clicking the eAlerts Subscriptions within online banking

How To:

We offer our members the chance to view their Vantage Score credit score for free in online banking. Scores are updated once every quarter, meaning any new credit activity or credit pulls won’t be reflected in your score in your online account until the next quarter. Here’s how to view your credit score:

Within Online Banking

- Login to online banking on your desktop computer

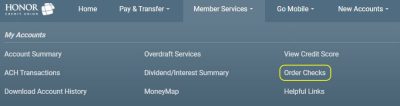

- Under the Member Services menu tab select View Credit Score

Within The Honor App

- Login

- Tap More, and then tap “View Credit Score”

Please Note: VantageScore is not available in mobile online banking on mobile devices. Your credit history will not be provided with your credit score in online or mobile banking. You can view your full credit report for free once per year at AnnualCreditReport.com.

Improve Your Credit Score

We have partnered with GreenPath Financial Wellness to help our members in all aspects of their financial lives, including their credit score. A GreenPath expert will work with you one-on-one to develp a plan to help you improve your score. The initial call to GreenPath is free!

Stay up to date on transactions happening within your account with eAlerts. One popular alert to setup is the ACH transaction alert. You can get notified anytime an ACH deposit, or withdrawal happens.

From Within Desktop/Laptop Online Banking

- In the top right corner of the screen, click your profile picture

- Click Personal Info & Settings

- Click eAlert Subscriptions

- Click the Create New eAlert button and follow the prompts on the screen

*Please Note: You must sign up for text banking to have alerts sent to mobile devices.

To access the funds in your pending ACH transaction early, use our Instant Deposit feature in online banking, or the mobile app.

- To learn how to use Instant Deposit click here

My Virtual Strong Box is the virtual answer to safe deposit boxes. It protects your data and gives you easy access to your important documents through cloud technology. You can upload important documents and access them online when you log into your Honor account.

Access It From Within Desktop/Laptop Online Banking

- After logging in to online banking select Virtual Strongbox from the Member Services menu.

A Personal Internet Branch (PIB) is a way to create a personalized online banking experience unique to you!

Security Control Options

- What days of the week and times of the day do you want your branch to be open for business

- Which PCs should be able to access your online branch

- What types of transactions can be performed

- Which types of transactions that should ask for a second, confirmation code

- How to limit transfers or other transactions to a certain maximum dollar amount

How To Create a PIB Within Desktop/Laptop Online Banking

Members already enrolled in online banking may create their PIB profile by clicking Manage My Security in the upper right-hand corner of your online banking homepage.

Check Your Credit Score

We offer our members the chance to view their VantageScore credit score for free online. Scores are updated once every quarter, meaning any new credit activity or credit pulls won’t be reflected in your score in your online account until the next quarter.

How To Check Your Credit Score*

- Log in to online banking on your desktop or laptop computer

- Under the Member Services menu tab select View Credit Score

- Download the app and log in

- Tap More, and then tap “View Credit Score”

Improve Your Score

Learn how a free call with our partners at GreenPath Financial Wellness can put you on a path to improve your credit score.

What Is VantageScore & How Does It Work?

Learn how VantageScore is different than FICO, and how you can check your credit score for free.

Please Note: VantageScore is not available in mobile browsers. Your credit history will not be provided with your credit score in online banking. You can view your full credit report for free once per year at AnnualCreditReport.com.

Mange Your Money Online

MoneyMap is an online money management tool, integrated into online banking, that empowers you to take control of your finances and simplify your life. Budgeting, account aggregation, categorization and mobile access are just a few of the tools to guide you along your way.

MoneyMap Features

- MoneyMap is easily accessible from online banking

- View all of your non-Honor accounts and credit cards in one place

- Visualize and interact with your budget using the Bubble Budget

- Track your expenses and get to know your spending habits

- Create your own customized debt plan for your lifestyle

- Quickly determine if you're moving in the right direction with your net worth

Reorder Checks

You can easily reorder more checks from within online banking on a desktop or laptop computer! You can also order more checks by visiting the Deluxe website directly.

Online Bill Pay

Online Bill Pay* is a free tool to help members schedule automatic payments, and much more through online banking and the mobile app.

Set Up

Bill Pay 24/7

Manage

Multiple Bills

Payments Logged In

Your Checking

Set Insufficient Funds

& Other Alerts

How To Set Up Online Bill Pay

- Once logged in, select Bill Pay from the Pay & Transfer menu tab

- From here you will click Add Payee

- You can select from a list of popular payees in the drop down menu, or by typing the business or organization name and then select continue*

- Once completed, click continue

Please Note: You will be able to enter the payment amount and the date you wish to initiate the payment. You will receive a confirmation to confirm payment details. If the information is correct, continue to submit your payment.

For electronic payments, the funds will be withdrawn on the selected payment send date. For check payments, the funds are withdrawn on the day the payee deposits the check.

*You will need the payee account information and billing zip code. You can also nick name the account for future use. If the organization or business does not accept electronic payments, you are able to send a check by clicking add check payee and entering the requested information.

- Log in to your account

- Tap Move Money

- Tap Bill Pay

- From here you will click Add Payee

- You can select from a list of popular payees in the drop down or by typing the business or organization name and then select continue*

- Once completed, click continue

Please Note: You will be able to enter the payment amount and the date you wish to initiate the payment. You will receive a confirmation to confirm payment details. If the information is correct, continue to submit your payment.

For electronic payments, the funds will be withdrawn on the selected payment send date. For check payments, the funds are withdrawn on the day the payee deposits the check.

*You will need the payee account information and billing zip code. You can also nick name the account for future use. If the organization or business does not accept electronic payments, you are able to send a check by clicking add check payee and entering the requested information.

*For security purposes, members are automatically unenrolled from Bill Pay if you have not used the service within 90 days of enrolling, or 12 months of inactivity. You can re-enroll for free at anytime.

Paying Bills Is Less Stressful With Online Bill Pay

Save time, get notified if you have insufficient funds, create alerts, and create automatic payments with Online Bill Pay.

e-Statements

Do you want faster access to your monthly statement in a more secure setting that also helps out the environment? E-Statements are your answer. Going paperless allows you to quickly email statements for tax purposes, or for your records! Learn how to enroll below.

Advantages

- eStatements are a FREE service offered to all of our Honor Credit Union members

- eStatements are available on the second day of every month, which is four to six days earlier than paper statements

- Because they are always available in online banking, and on the Honor mobile app, you don't have to worry about losing paper statements, and you're helping the environment

- Set alerts for when automatic deposits or withdrawals are processed by clicking the eAlerts Subscriptions within online banking

How To Enroll Within Desktop Online Banking

- Log in to online banking, and from the Member Services menu tab select eStatements

- Please Note: Enrollment feature not available on mobile devices

- Click the button next to “I would like to receive my statements electronically” and enter the email address where you would like your e-statement notice sent

- Click “Accept”

Online Banking FAQs

If you forget your password, you can click on ‘Forgot Password’ and enter your username then hit continue. Next step is to answer your three security questions and hit ‘Proceed to change Password’.

If you can’t answer your questions correctly, you will need to contact us to reset your questions and password. After we verify your identity, we can reset your questions and password for you and then you will need to log in right away and set up new ones.

You will need contact us and we can unlock your account and reset your password and questions for you. After we verify your identity, we can reset your questions and password for you and then you will need to log in right away and set up new ones.

Your initial temporary password is only good for 24 hours and must be changed within that time frame. If outside of that time frame you will need to have the password reset. Please contact our Virtual Member Center at 800.442.2800 for assistance.

It’s easy to view, set, and change your code word within online banking! Here’s how:

- After logging in, click your profile picture in the top right corner

- Select Personal Info & Settings

- Select Personal Information

- Click the Edit Personal Information button and make your changes

- Click the Update button when you’re done making changes

To log in to online banking click here.

Honor’s online banking and mobile app have a See/Jump feature built in that allows joint account owners access to each other’s accounts.

This feature allows you to:

- See: Monitor balances, transaction activity, account summaries, etc.

- Jump: Gives parents/guardians the ability to log into their child’s accounts. They can make transfers, change preferences, and do almost anything else, except apply for a loan.

To sign up for See/Jump, please call or text 800.442.2800, or visit a local Honor member center.

To Use See/Jump In Online Banking:

- Log in to online banking

- Click your profile picture in the top right corner of the screen and select the account you wish to view

To Use See/Jump In The Mobile App:

- Log in

- Tap My Accounts

- Tap My Other Memberships

- Once you are logged in, select ‘Pay & Transfer.’ and then choose Quick Transfer for an immediate transaction, or select Schedule a Transfer for a future transaction.

- You can transfer money to any of your accounts (except IRA’s), as well as other Honor members’ accounts.

- If you are transferring money to another member, you will need their membership number, account suffix, and first three letters of their last name to complete the transfer.

Yes! You can pay non-members using our Pay Anyone tool.

- Log in to online banking

- From the Pay & Transfer menu tab at the top select ‘Pay Anyone’.

- You will need to know the person’s name, and email or phone number to send the money to.

* Please Note: Once you have sent the money, there is no way to cancel it or receive a refund. Please make sure you have correctly typed in the email or phone number.

Yes, you can!

- Log in to online banking

- Select your loan account from the list of Favorite on the home screen, or at the end of your list of Favorites select See Full Account Summary to see all of your accounts.

- Click Account Details

- The loan details screen will then show you the due date, along with payment details, interest rate, payoff balance, and original loan balance.

Your mortgage might be serviced through Midwest Loan Services. If that’s the case you will have to login through their website.